Business Insurance in and around Georgetown

Georgetown! Look no further for small business insurance.

Almost 100 years of helping small businesses

Cost Effective Insurance For Your Business.

Small business owners like you have a lot of responsibility. From tech support to product developer, you do as much as possible each day to make your business a success. Are you a fence contractor, a surveyor or a florist? Do you own a travel agency, a hobby shop or a vet hospital? Whatever you do, State Farm may have small business insurance to cover it.

Georgetown! Look no further for small business insurance.

Almost 100 years of helping small businesses

Protect Your Future With State Farm

You are dedicated to your small business like State Farm is dedicated to reliable insurance. That's why it only makes sense to check out their coverage offerings for business owners policies, commercial auto or builders risk insurance.

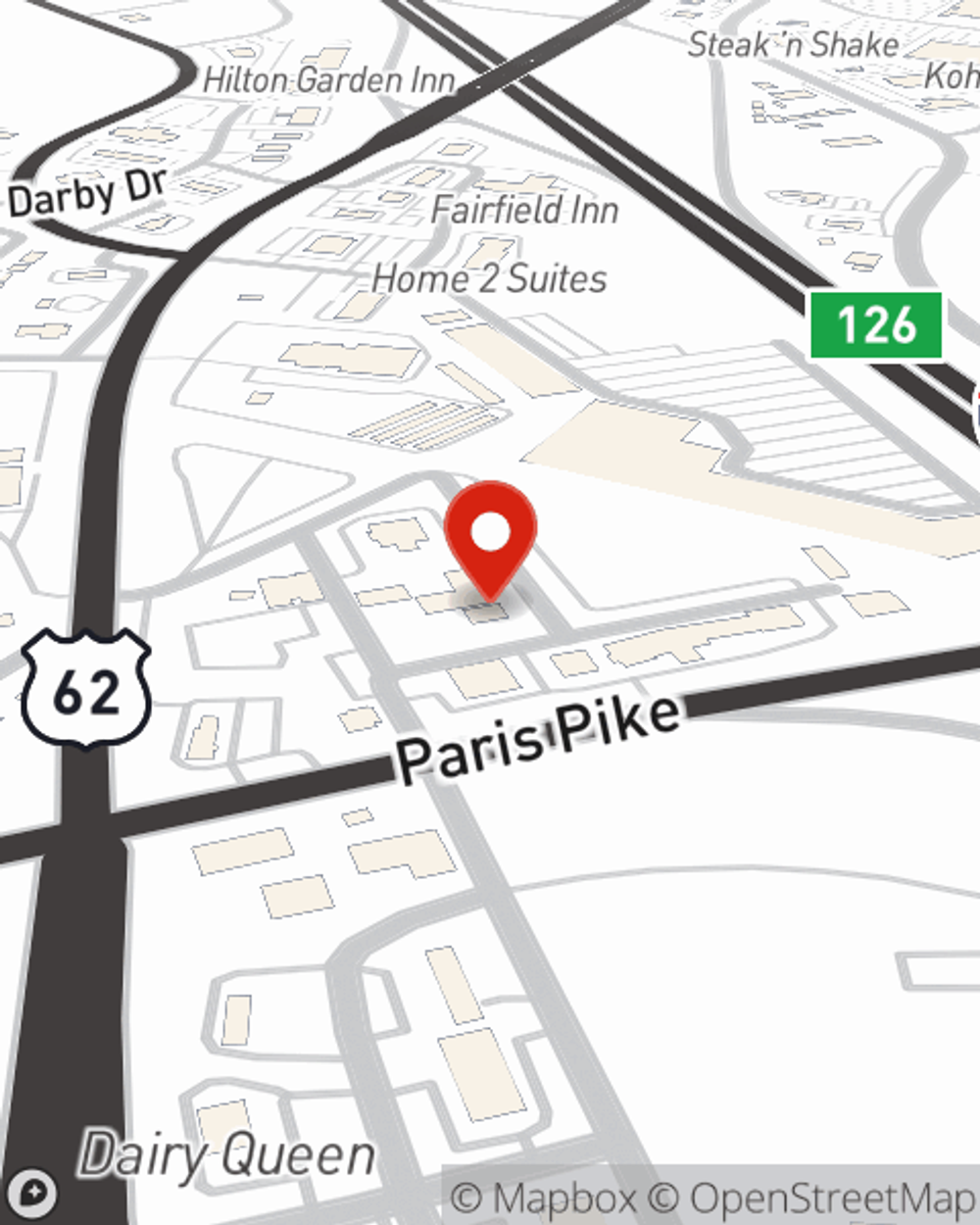

The right coverages can help keep your business safe. Consider reaching out to State Farm agent Sophia Kenealy's office today to discover your options and get started!

Simple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Sophia Kenealy

State Farm® Insurance AgentSimple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.